April

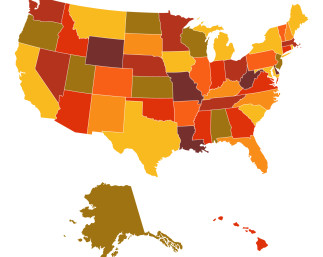

State Tax Debt

State tax comptrollers may be even more aggressive than IRS revenue officers. This is because the state relies, to a much larger degree, on year-over-year tax payments to generate revenue. State collection agencies have been known to levy wages, empty bank accounts and shut down businesses, not as a last resort but as a primary tactic in order to settle an outstanding state tax debt. State collection agencies have also become more aggressive since the economic downturn, and this opportunistic strategy has stuck despite recovery.

Similar to the IRS, all state tax boards must offer repayment plans where appropriate and negotiate wherever possible.

Most states provide an Offer of Compromise and reduced payment options. However, some states may waive penalties but not interest, and vice versa. We encourage you to contact our offices to get the information you need about your specific liability in your state of residence as opposed to contacting a state comptroller and being subject to abusive collection tactics.

Call 888-503-2388 Or Click Here

An Enrolled Agent, Tax Attotney or CPA must be elected to represent you before a state tax board. Tax Attorney Now’s associates can advise you of your rights and represent you during state tax debt collection proceedings. Both businesses and individual taxpayers should refuse to become a victim to aggressive tactics and can, with the help of a certified tax team.

- Reduce penalties

- Reduce interest

- Mediate state tax debt

State Tax Debt Attorney

Electing a Tax Attorney to represent you when facing a state tax debt will not only save you time, but bring you a sense of freedom. Before we can help, you must help yourself and contact a representative to get the best defense. Such matters must and should be settled by professionals.

A personal account manager is assigned to you during this process to guide you through and explain necessary information related to your account, while steering you clear of the exhaustive details. Meanwhile, your defense is being built on extensive research of your tax returns and master tax file with the IRS, and the items to be audited including any supporting documentation that supports our defense.

Our associates and tax attorneys have been representing taxpayers with outstanding state tax debt for many years. Even in instances where clients had to pay, settlements have been mediated quickly and reasonably.

Related Articles

Finished Your Taxes? Now What Records Should You Keep?

You’ve dotted the i’s, crossed the t’s, and set up a shortcut to the refund tracker on your browser. Now you have a pile, or hopefully a hard drive, full of receipts and documents pertaining to your financial circumstances. Do..

Read More3 Ways to Keep Business and Personal Finances Separate

Your business life and your personal life are bound to run together; you hit the gym on your lunch break, grab a meal with your client, and buy your boss a friendly holiday gift. However, it’s important to separate the..

Read More